[April 2024] Both the historical trend in the actual construction of new coal-fired power plants worldwide as well as the currently known projects in planning or approval state indicate that demand for new plants continues to exist overall, albeit with a slight downward trend.

Based on active research and its own experience with the marketing of power plants, the troveo team regularly analyses the target countries for the construction, renewal and conversion of coal-fired power plants.

The main sources of data, which are updated quarterly, are the by country tables on the development of the coal-fired power plant market provided by the independent study group “Global Energy Monitor (GEM)” from Canada and the articles of the independent think tank “Carbon Tracker” based in London.

These updates include tables from GEM by country:

– The current status of installed power plant capacity

– The annual expansion of installed power plant capacity over the last 23 years

– The total power plant capacity currently planned and under construction

– New power plant capacity added, planned and under construction in the last quarters

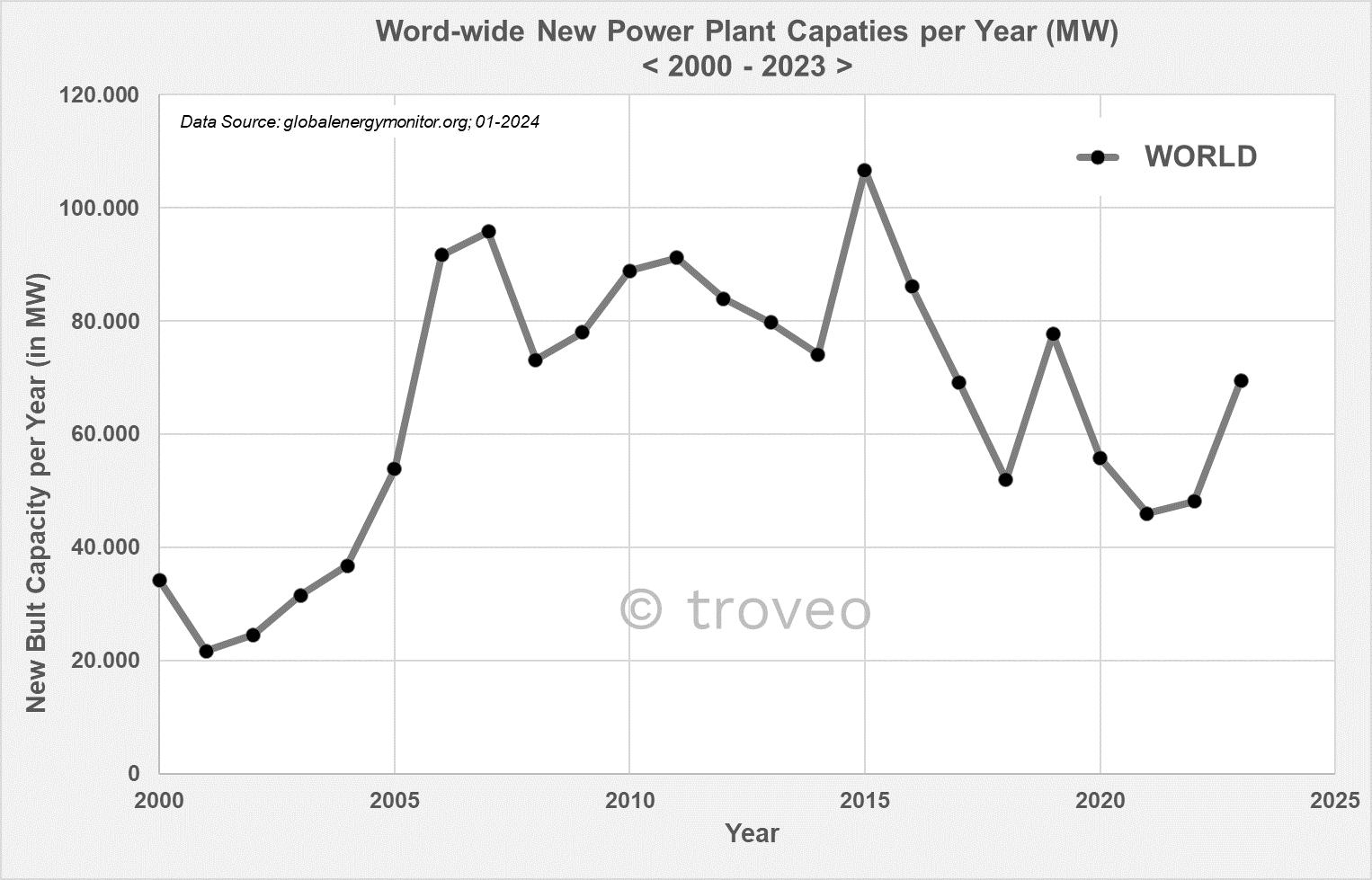

The annual additions in Megawatts are particularly significant: As the following chart shows, the trend for new construction projects has been declining since around 2017.

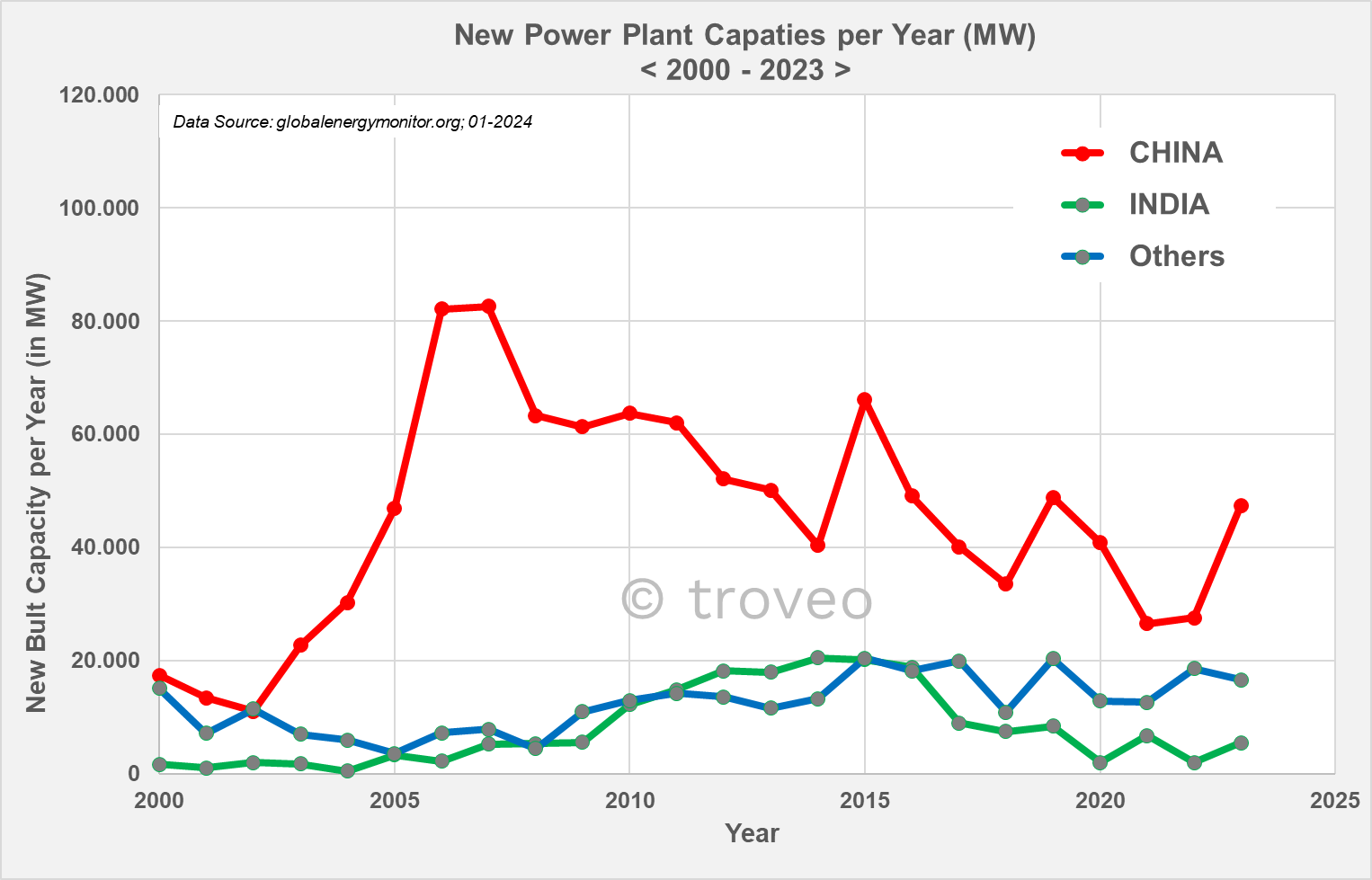

Broken down by individual countries, China has by far the highest annual rate of new installations, followed by India. A differentiated view is therefore appropriate, as shown in the following diagram:

This more differentiated figure shows that a peak was reached in China around 2006/2007, while India saw the highest rates of new installations between 2012 and 2016, albeit with significantly lower annual values overall. In both countries, new installations have been falling steadily since then, albeit with fluctuations.

The remaining approx. 50 countries with new coal-fired power plants experienced an increase in new capacity between 2005 and 2015, which has continued at a constant level since 2016. An imminent end to the construction of new coal-fired power plants cannot be deduced from these trends.

This is also confirmed by other GEM tables on the status of currently planned measures: This extensive data base shows that the currently quantified expansion is primarily taking place in Asia, even if China is not included. At around 45 Gigawatts per year, India has by far the highest national figure after China. Asia is also the most active market for used power plant technology, both in terms of purchases and sales.

Worldwide – excluding China – the currently known, planned or approved construction of new coal-fired power plants is around 110 Gigawatts. This does not include new power generation capacities at industrial plants.

Amongst other things, the general potential for the re-use of used components or component groups from coal-fired power plants can be derived from this data for each target country. Re-use as a bridging technology is particularly suitable for urgent projects or projects with low investment budgets, whether for new builds or for refurbishments or replacements.

If you are interested in such market trends, please send us a message to team@troveo.de. We look forward to exchanging expertise with you.